68. Private Tax Sale, Mercer County, PA City of Sharon September 12, 2018

Notes On the Private Tax Sale Review.

What is a private tax sale?

A Private tax sale is a tax sale of a tax delinquent property supervised and conducted by a Pennsylvania County Tax Claim Office supervised by a Pennsylvania County Board of Commissioners. (See: Title 72 of Pennsylvania Consolidated Statutes is entitled Taxation and Fiscal Affairs.)

A private tax sale eliminates tax liens only. It has less administrative costs to the buyer

than a Judicial Sale. The bidding process is best described as administrative and not subject to the competitive bidding of a public auction.

A judicial tax sale eliminates both tax liens and private liens. Its administrative costs to the buyer are higher than those in a private tax sale. The bidding is transparent and competitive.

At the website for the Mercer County Bar Association’s Legal Journal,

(https://www.palegalads.org/journals/pdf/

783_MCLJ_OL_33_30_July_24_2018.pdf) in July, the private tax sale was publicized.

In comparison the upset tax sale is published in the newspaper. A judicial tax sale is published on the Mercer County Tax Claim Bureau website.

Information about a private tax sale is not as transparent or accessible to the public as information for an upset tax sale or judicial sale.

Through a freedom of information request the bid amounts and buyers for the September 12, 2018, private tax sale were provided by the Mercer County Tax Claim Office.

Of the 38 properties that were cleared at the private tax sale, 3 buyers bought, 24 of the

38 properties:

1. 9 were bought by Terence Whalen of Shenango Valley Homes, Mercer, PA.

What is a private tax sale?

A Private tax sale is a tax sale of a tax delinquent property supervised and conducted by a Pennsylvania County Tax Claim Office supervised by a Pennsylvania County Board of Commissioners. (See: Title 72 of Pennsylvania Consolidated Statutes is entitled Taxation and Fiscal Affairs.)

A private tax sale eliminates tax liens only. It has less administrative costs to the buyer

than a Judicial Sale. The bidding process is best described as administrative and not subject to the competitive bidding of a public auction.

A judicial tax sale eliminates both tax liens and private liens. Its administrative costs to the buyer are higher than those in a private tax sale. The bidding is transparent and competitive.

At the website for the Mercer County Bar Association’s Legal Journal,

(https://www.palegalads.org/journals/pdf/

783_MCLJ_OL_33_30_July_24_2018.pdf) in July, the private tax sale was publicized.

In comparison the upset tax sale is published in the newspaper. A judicial tax sale is published on the Mercer County Tax Claim Bureau website.

Information about a private tax sale is not as transparent or accessible to the public as information for an upset tax sale or judicial sale.

Through a freedom of information request the bid amounts and buyers for the September 12, 2018, private tax sale were provided by the Mercer County Tax Claim Office.

Of the 38 properties that were cleared at the private tax sale, 3 buyers bought, 24 of the

38 properties:

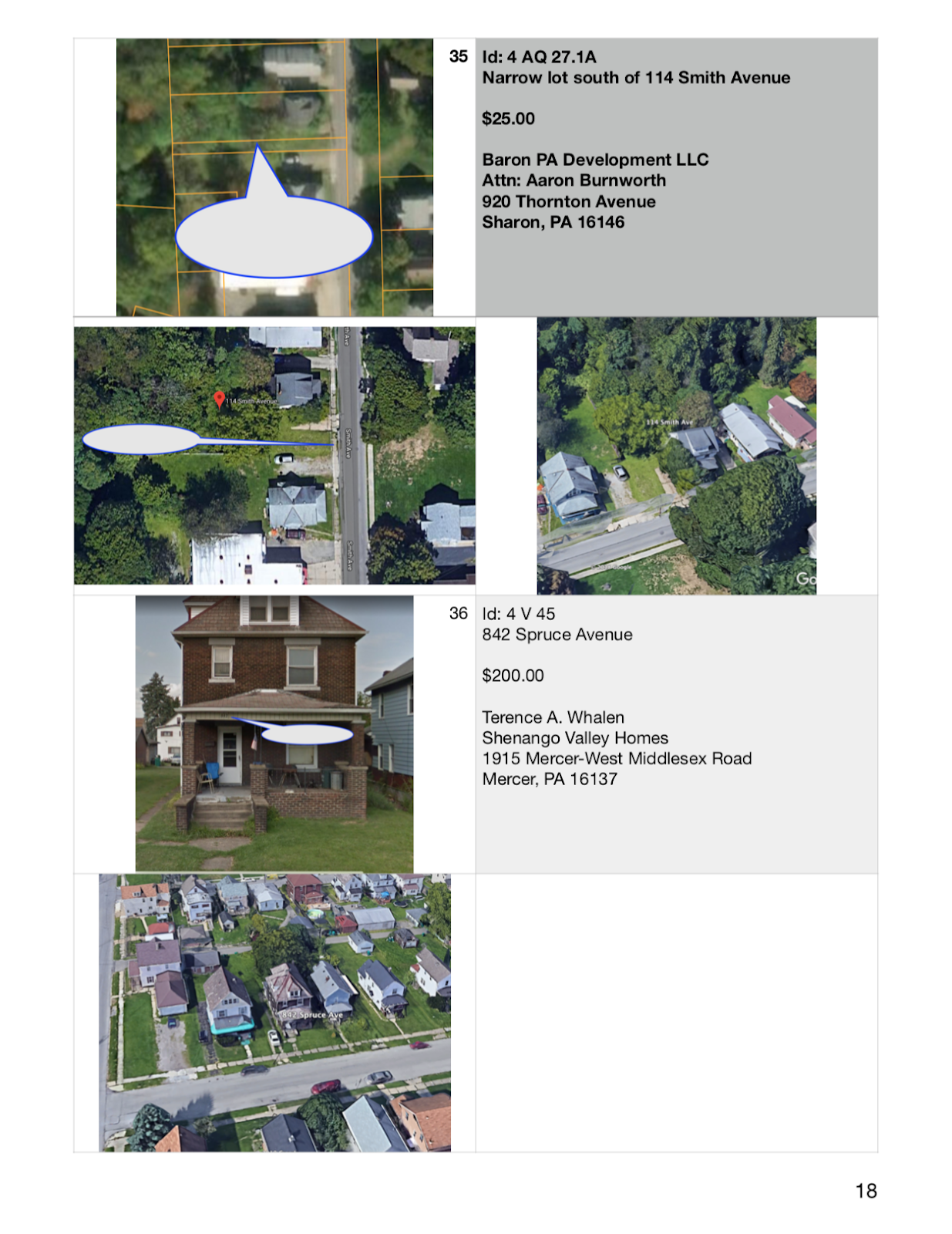

1. 9 were bought by Terence Whalen of Shenango Valley Homes, Mercer, PA.

2. 7 were bought by Aaron Burnworth of Baron PA

Development LLC, Sharon, PA.

3. 6 were bought by Jarrett Whalen of Home Town Community Rentals, Sharon, PA.

None of the bid amounts exceeded $500.00.

None of the buyers have any obligation to be in accordance with law and pay taxes on the properties in the future.

None of the buyers have any obligation to rehabilitate the properties bought or contribute with the acquired properties to the revitalization of the City of Sharon or create affordable housing opportunities for

persons seeking housing.

Had a structure and vacant lot revitalization Land Bank been operational, these properties could have been managed for their rehabilitation in the revitalization of the City of Sharon. By a Land Bank’s ability to create contracts, the inherent defects for the community by......................................................

a county tax sale ( upset, private, judicial) can be avoided.

The inherent defects are, as has been noted: No obligation for the buyer to do anything with a purchased property: taxes, rehabilitate, demolish.

A Land Bank would end the cycle of "free market anarchy" that

has afflicted the City of Sharon for decades.

Photographs of the properties sold at the private tax on September 9, 2018, are on the following 19 pages . With each photograph there is the Parcel ID, address, purchase price and name of the buyer. Most of the properties were deteriorated requiring rehabilitation. Their order is generally from north to south:

3. 6 were bought by Jarrett Whalen of Home Town Community Rentals, Sharon, PA.

None of the bid amounts exceeded $500.00.

None of the buyers have any obligation to be in accordance with law and pay taxes on the properties in the future.

None of the buyers have any obligation to rehabilitate the properties bought or contribute with the acquired properties to the revitalization of the City of Sharon or create affordable housing opportunities for

persons seeking housing.

Had a structure and vacant lot revitalization Land Bank been operational, these properties could have been managed for their rehabilitation in the revitalization of the City of Sharon. By a Land Bank’s ability to create contracts, the inherent defects for the community by......................................................

a county tax sale ( upset, private, judicial) can be avoided.

The inherent defects are, as has been noted: No obligation for the buyer to do anything with a purchased property: taxes, rehabilitate, demolish.

A Land Bank would end the cycle of "free market anarchy" that

has afflicted the City of Sharon for decades.

Photographs of the properties sold at the private tax on September 9, 2018, are on the following 19 pages . With each photograph there is the Parcel ID, address, purchase price and name of the buyer. Most of the properties were deteriorated requiring rehabilitation. Their order is generally from north to south: